Law firms should employ different billing models to accommodate their clients’ needs and optimize revenue generation.

Setting the right billing rates for your law firm is crucial for your success. It’s not just about being competitive; it’s also about ensuring profitability while considering market realities, such as prevailing rates, your firm’s reputation, and your clients’ ability to pay. In this blog, we’ll explore the key factors to consider when determining your law firm billing rates and provide insights into optimizing your pricing strategy for long-term success.

Benchmarking Your Law Firm Billing Rates

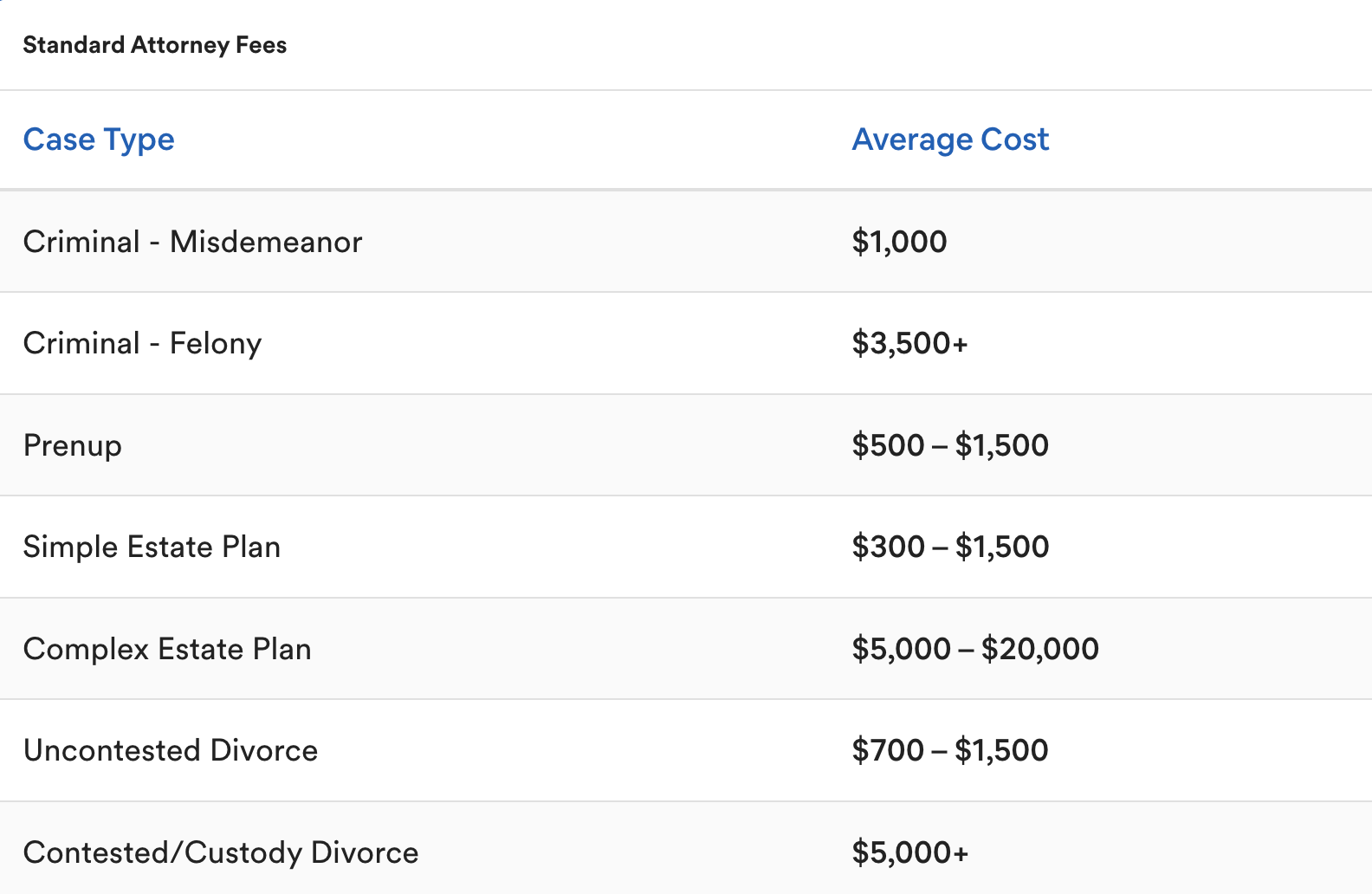

To establish a solid foundation for your billing rates, it’s essential to understand industry benchmarks. Knowing what top law firms charge per hour can serve as a starting point for your pricing strategy. According to recent statistics, the average national billing rate for law firms is $225 per hour. However, keep in mind that rates may vary depending on your location (law firms operating in big cities charge closer to $400/hr or more, while small-town firms tend to charge less), practice area, and level of expertise. Below is a breakdown of common average attorney fees per case type.

To help determine the best legal billing rate for your firm, you can utilize industry surveys, geographic averages, and peer comparisons. These resources provide valuable insights into prevailing billing rates for specific legal services, allowing you to align your pricing with industry standards.

Common Billing Models in Legal Services

Law firms should employ different billing models to accommodate their clients’ needs and optimize revenue generation. Understanding the different models and their advantages and disadvantages can help you determine the most suitable approach for your firm. The most common law firm billing models include:

Hourly Rate

This model bills clients for the exact amount of time and effort dedicated to their legal matters. However, clients may be concerned about potential time inefficiencies or the unpredictability of costs.

Retainer

A retainer fee is a predetermined amount that clients pay upfront to secure ongoing legal services and availability from the law firm. This fee serves as a deposit, which is typically applied towards future billable hours or services rendered. By establishing a retainer agreement, clients have the peace of mind of knowing that the law firm is committed to providing timely assistance whenever needed, and the retainer fee ensures priority access to legal expertise. It offers clients a sense of security and enables law firms to allocate resources effectively, fostering a mutually beneficial relationship.

Flat Fee

This model offers a fixed price for specific legal services, regardless of the time invested. With a flat fee model, clients know the total cost upfront, providing them with cost certainty. This approach is often used for routine legal tasks with predictable workloads. However, it may not be suitable for complex or unpredictable cases where the scope of work can change.

Contingency Fee

Contingency fees involve receiving payment as a percentage of the client’s legal settlement or court-awarded damages. In a contingency model, it’s common to observe attorney percentage fees averaging approximately one-third of the total legal settlement fees awarded to the client. Clients appreciate this model as they only pay if the case is successful. However, it carries a higher risk for the law firm, as there is no guarantee of payment if the case does not succeed.

Blended Rate

A blended rate combines various billing methods to provide flexibility and align pricing with different tasks and expertise levels. The blended rate model allows you to customize your billing approach based on the specific requirements of each case. For example, you might charge a flat fee for initial consultations, an hourly rate for research and document preparation, and a contingency fee for trial representation. This model provides a balance between cost transparency and flexibility, catering to different client needs.

The Role of Value Billing

In recent years, there has been a shift towards value billing in the legal industry. Value billing focuses on the outcomes and value delivered to clients, rather than solely relying on billable hours. By understanding the value your services bring to clients, you can factor it into your pricing strategy. This approach helps ensure that you charge a fair rate that aligns with the impact and benefits your firm provides.

Having access to accurate and comprehensive data enables firms to make informed decisions when it comes to adjusting their billing rates.

Use Your Data to Adjust Your Legal Billing Rates

When determining what your law firm’s billing rates should be, consider the following:

- Your years of experience

- The complexity of your case types

- The profitability of past cases

- How long it takes to close cases

- The urgency of your clients’ cases

- Your firm’s operational costs

Data plays a vital role in informing fee adjustments for law firms. Having access to accurate and comprehensive data enables firms to make informed decisions when it comes to adjusting their billing rates. By leveraging data on billable hours, revenue per case, and profitability analysis, firms can gain valuable insights into their financial performance. This data allows them to evaluate the effectiveness of their current fee structures and identify areas for improvement. Whether it’s adapting to market changes, aligning rates with the value provided, or staying competitive, data-driven fee adjustments ensure that firms are making strategic decisions based on actual performance metrics, not just hunches. By utilizing data to inform fee adjustments, law firms can optimize their billing practices, improve profitability, and ensure they are charging an appropriate and competitive rate for their services.

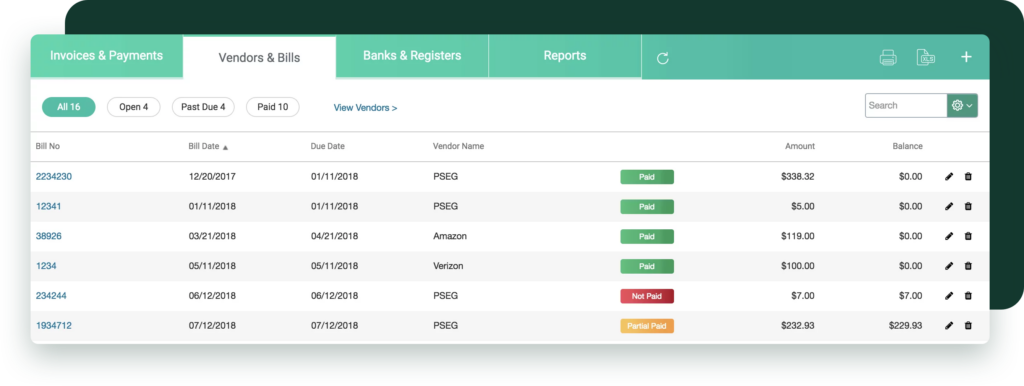

Data-driven billing in CARET Legal

Regularly Reviewing and Adjusting Your Billing Rates

It’s crucial to your long-term success to regularly evaluate your law firm’s billing rates. As mentioned, economic conditions, market changes, growth, and your firm’s evolving expertise all influence the value of your services. By reviewing and adjusting your rates periodically, you can adapt to the evolving landscape and ensure that your pricing remains fair and competitive. Additionally, clients appreciate knowing what to expect upfront, which fosters trust and prevents misunderstandings.

How CARET Legal Supports Effective Billing Rate Management

Effortlessly adjusting billing rates over time becomes a breeze when you have all the necessary data automatically tracked within a comprehensive legal practice management system like CARET Legal. Recognizing the significance of efficient billing rate management for law firms, our platform goes beyond simplifying the payment process. With CARET Legal, you can automate time tracking, effortlessly generate detailed reports and analytics, and gain valuable insights into your firm’s financial performance. This data-driven approach empowers you to streamline your billing workflow, enhance profitability, and make informed decisions regarding resource allocation. By leveraging our user-friendly interface, you can focus your energy where it truly matters: delivering exceptional legal services to your clients.

Embrace a future-ready, data-driven approach to law firm billing. By benchmarking your rates, considering legal billing guidelines, exploring various billing models, and regularly reviewing and adjusting your rates, you can enhance profitability, resource allocation, and client satisfaction.